Technology

Starting a business for your app

A guide for developers

Disclaimer: I am not a lawyer and this is not legal advice. Before starting a business, you should consult your own lawyer.

We developers are uniquely positioned to start our own companies. I don’t mean to downplay the importance of managers, accountants, salespeople, and everyone else who makes a business come together, but devs bring something very rare to the table: the ability to call forth an entire high-value product from the abyss, using no raw materials whatsoever. A developer can disappear into a basement alone for a few weeks and come out with the next billion-dollar app.

If you’ve ever considered starting your own business, either to sell a product you’ve created or to take contract work, you might be intimidated by the mixture of prestige and risk that popular culture associates with being a businessman. Before we go any further, I want to dispel some false ideas you may have picked up:

- You don’t need thousands of dollars to start a business. You won’t lose your life’s savings overnight (unless you randomly spend it all, I guess).

- You don’t need to quit your day job to start a business.

- You don’t need a loan to start a business. You don’t need investors. You don’t need to go on Shark Tank.

- You don’t need to give up all your free time to start a business.

- You don’t need an MBA to start a business.

- You don’t need an office to start a business. Your basement will do. You don’t even need a suit and tie. I showed up to the bank in a hoodie-shirt and jeans.

- You don’t need to hire or partner with anybody to start a business.

- You don’t need to be ambitious or charismatic or brave to start a business.

So what do you need? These four things:

- Something to sell. My company sells subscriptions to a webapp for novel writers. Yours might sell your time and knowledge.

- A name for your company. It can be your own legal name, if you want.

- A few spare hours between 9 and 5.

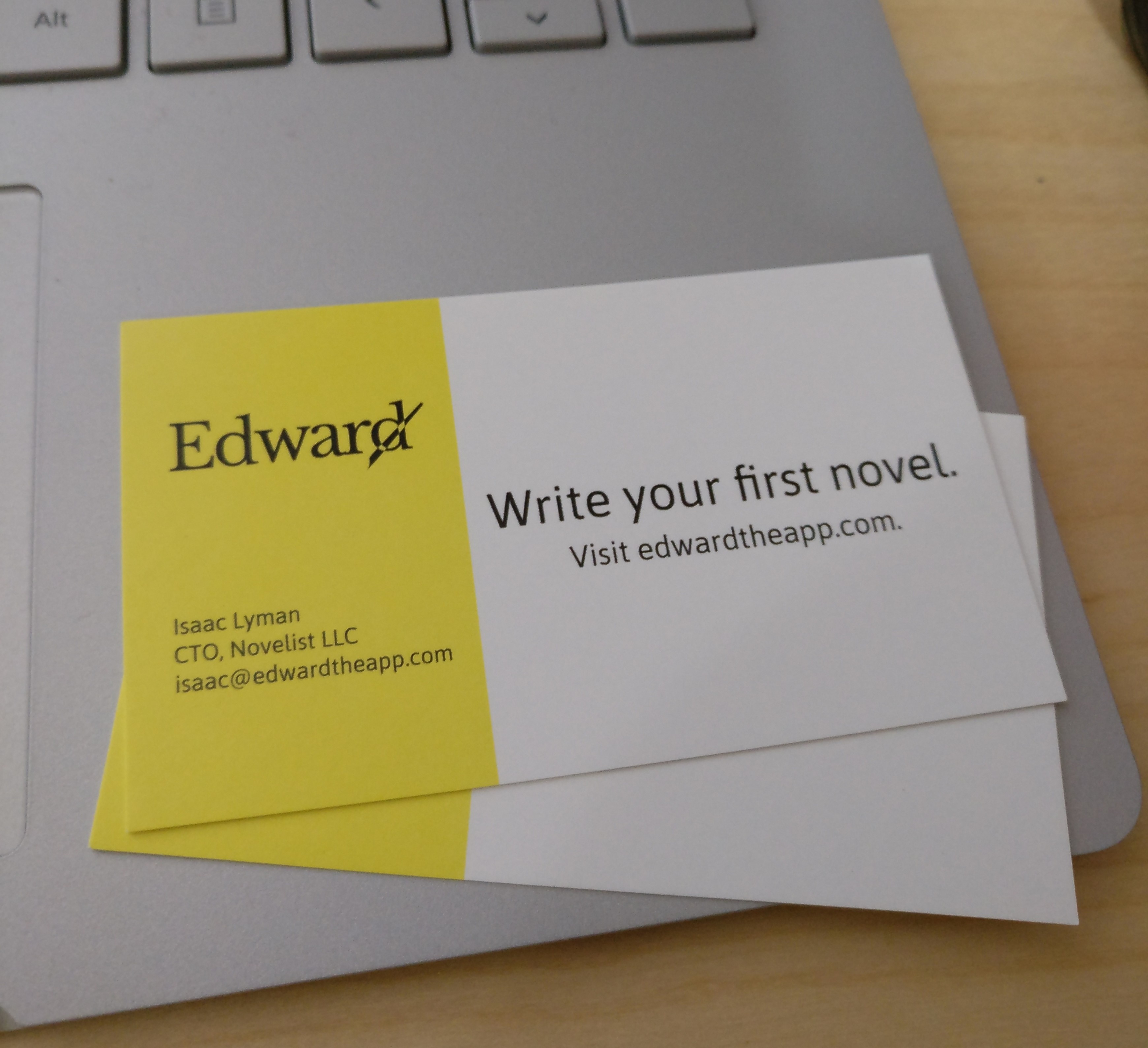

- $150 or so, for business registration fees and (optionally) business cards.

One caveat: I live in Utah, USA. The process and fees will differ somewhat depending on your location. (California, for example, has famously high taxes on small businesses.)

$150 isn’t a ton of money, but it’s not pocket change, either. You may wonder why you should spend the time and money to incorporate when you could just sell your product as an individual and report the income to the IRS along with your salary (that’s totally legal to do). And there’s one simple reason: liability. Getting sued is common and expensive in the United States, and doing business as a legally registered company separates your personal assets from your business assets, so if someone has a problem with your product and sues, the court can’t take away your house or car, garnish your wages, or take anything else belonging to you. Your company might go bankrupt in that situation, but that’s far from a worst-case scenario. So in the interest of protecting yourself, your possessions and your family, incorporating is the way to go.

Starting a business in the U.S. is pretty simple.

- Decide what to name your business. You probably want an LLC, or Limited Liability Company, which is the simplest possible form of corporation. If you’re the only owner of your LLC, you don’t even have to file a special form at tax time; you can just report everything the LLC makes as personal income.

- Get an EIN (Employer Identification Number) from the federal government. This is a number that identifies your company on tax documents and other paperwork. You can get one here for free.

- Register your business with the state. You need to register in the state where you have nexus, which pretty much just means the state where your headquarters is located. You can use your home address as the business address. Utah has one-stop business registration online; check Google to figure out the process in your own state.

- If you plan to sell a “tangible product,” including software or any form of swag, you’ll need a sales tax identification number. You’ll have to file your sales taxes monthly, quarterly or annually, depending on how much money you’re making on these sales. This will come up during your business registration.

- Once your business is registered, go to your local bank or credit union and set up a business checking account. They’ll give you a credit or debit card to use for business transactions, which makes it easy to write off expenses when you file your taxes.

- Figure out how you’re going to handle accounting. You can get a basic QuickBooks account for cheap, which connects to your online bank account and lets you classify business expenses, income, your own investments, and dispersements (money your business pays you).

- Be very careful about how you use your business credit/debit card and account. If you use business funds to pay for something that isn’t relevant to your business (like groceries or a vacation), that’s called “commingling of assets” and it destroys the legal barrier between your business assets and personal assets. If your company gets sued and the prosecution can prove that you used your business funds to pay for personal stuff, they can sue for everything you own. On the other hand, you can add money to your business accounts (called an “owner’s investment”) or transfer money from your business to your personal account (called “owner’s pay”) at any time, as long as you document it. One small transaction can make a huge difference for your legal protections.

- Set up your payment provider or clients to deposit your income directly into your business account, and you’re all set!

Congratulations, you’re a small business owner! (I also like the term “microstartup CEO.”) Now you can move on to the exciting stuff: business cards, advertising, getting a feature in the local newspaper, and (of course) building even more cool stuff.

Good luck!